In today’s ever-evolving financial landscape, it’s crucial to make the most of your hard-earned money. One effective strategy to achieve this is by exploring high yield savings accounts, which offer the potential for substantial growth in your savings. Join me as we delve into the world of these powerful financial tools and uncover the best options to propel your savings to new heights.

Understanding High Yield Savings Accounts

A high yield savings account is a type of deposit account that typically offers higher interest rates compared to traditional savings accounts. These accounts are designed to help you grow your savings faster by earning more interest on your deposited funds.

The concept behind high yield savings accounts is simple: the more interest you earn, the quicker your savings will accumulate. By taking advantage of these higher interest rates, you can maximize the growth potential of your money and achieve your financial goals more efficiently.

Benefits

- Higher Interest Rates: The primary advantage of high yield savings accounts is the ability to earn more interest on your deposited funds. This means your money grows at a faster rate compared to traditional savings accounts.

- Compounding Interest: As your interest accumulates, it is added to your principal balance, allowing you to earn interest on the interest itself – a powerful concept known as compounding interest.

- Liquidity: High yield savings accounts typically offer easy access to your funds, allowing you to withdraw or transfer money when needed, while still earning competitive interest rates.

- Safety: Many high yield savings accounts are FDIC-insured (or NCUA-insured for credit unions), providing protection for your deposits up to the insured limit.

Factors to Consider When Choosing a High Yield Savings Account

While the prospect of earning higher interest rates is enticing, it’s essential to evaluate various factors before selecting a high yield savings account. Here are some key considerations:

- Interest Rates: Compare the annual percentage yield (APY) offered by different financial institutions to find the highest rates available. Keep in mind that rates can fluctuate, so it’s wise to periodically review and adjust your account if necessary.

- Fees and Minimums: Examine any associated fees, such as monthly maintenance charges or minimum balance requirements. These fees can potentially offset the benefits of higher interest rates, so it’s crucial to understand them thoroughly.

- Access to Funds: Assess the accessibility of your funds and any potential restrictions or penalties for withdrawals or transfers. Ensure the account aligns with your liquidity needs.

- Financial Institution’s Reputation: Research the financial institution’s stability, customer service, and overall reputation. A reputable institution with a strong track record can provide peace of mind and ensure the safety of your savings.

- Online or Traditional Banking: Consider whether you prefer the convenience of an online-only account or the personal touch of a traditional brick-and-mortar bank or credit union.

Top High Yield Savings Accounts in the Market

To help you navigate the vast array of options, we’ve compiled a list of some of the top high yield savings accounts currently available in the market:

- Ally Bank Online Savings Account: Ally Bank is an industry leader in online banking, offering a competitive APY and no minimum balance requirements.

- Marcus by Goldman Sachs Online Savings Account: With a strong reputation and attractive APY, Marcus by Goldman Sachs is a popular choice for online savers.

- Vio Bank High Yield Online Savings Account: Vio Bank boasts a consistently high APY and a user-friendly online platform.

- Citi Accelerate Savings Account: Citi’s high yield savings account offers a tiered interest rate structure, rewarding higher balances with higher APYs.

- Discover Online Savings Account: Discover Bank’s online savings account provides a competitive APY and the convenience of online banking.

Comparison of the Best Savings Accounts

To help you make an informed decision, we’ve compiled a comprehensive comparison of the top high yield savings accounts, highlighting their key features:

| Account | APY (as of May 2024) | Minimum Balance | Monthly Fees | FDIC/NCUA Insured |

|---|---|---|---|---|

| Ally Bank Online Savings Account | 3.30% | $0 | $0 | FDIC |

| Marcus by Goldman Sachs Online Savings Account | 3.30% | $0 | $0 | FDIC |

| Vio Bank High Yield Online Savings Account | 3.35% | $100 | $0 | FDIC |

| Citi Accelerate Savings Account | 3.25% (up to $500k) | $0 | $0 | FDIC |

| Discover Online Savings Account | 3.30% | $0 | $0 | FDIC |

Please note that interest rates are subject to change, and it’s essential to verify the most current rates before opening an account.

Online Savings Accounts vs. Traditional Savings Accounts

As technology continues to shape the financial landscape, online savings accounts have emerged as a popular alternative to traditional brick-and-mortar options. Here’s a comparison of the two:

Online Savings Accounts

- Higher Interest Rates: Online banks typically offer higher APYs due to lower overhead costs associated with maintaining physical branches.

- Convenience: Access your account and manage your funds from anywhere, at any time, via a secure online platform or mobile app.

- Lower Fees: Many online banks charge fewer fees or have lower minimum balance requirements compared to traditional banks.

- Limited In-Person Services: While online banking offers convenience, some customers may prefer the personal touch of in-person interactions.

Traditional Savings Accounts

- Physical Branches: Traditional banks offer the convenience of in-person service and face-to-face interactions with banking representatives.

- Lower Interest Rates: Due to higher overhead costs associated with maintaining physical locations, traditional banks often offer lower APYs on savings accounts.

- Additional Services: Traditional banks may provide a wider range of services, such as loans, investments, and financial planning, under one roof.

- Potential Fees: Traditional banks may charge higher fees or require higher minimum balances to avoid monthly maintenance charges.

Tips for Maximizing Your Savings

To truly harness the power of high yield savings accounts and accelerate your savings growth, consider the following tips:

- Automate Your Savings: Set up automatic transfers from your checking account to your high yield savings account, ensuring consistent contributions without the need for manual intervention.

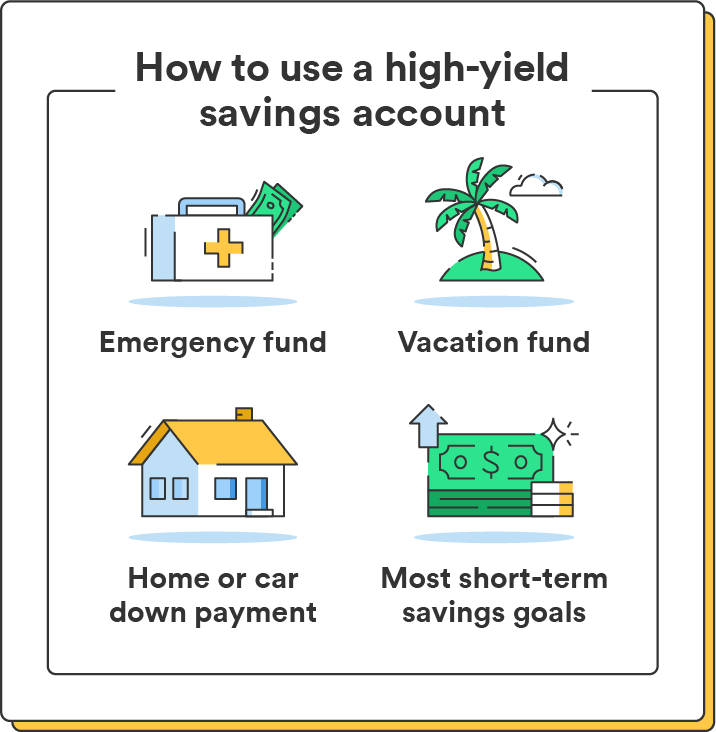

- Prioritize Savings Goals: Establish specific savings goals, such as an emergency fund, a down payment for a home, or retirement savings, and allocate a portion of your income towards achieving those goals through your high yield savings account.

- Leverage Compound Interest: Leave your interest earnings in the account to benefit from the compounding effect, allowing your money to grow exponentially over time.

- Review and Adjust Periodically: Regularly review the interest rates offered by various financial institutions and consider switching accounts if a better rate becomes available.

- Combine with Other Savings Strategies: Utilize high yield savings accounts in conjunction with other savings strategies, such as contributing to retirement accounts or investing in diversified portfolios, to maximize your overall financial growth.

How to Open a High Yield Savings Account

Opening a high yield savings account is generally a straightforward process. Here are the typical steps:

- Research and Compare Options: Explore different financial institutions and compare their high yield savings account offerings based on interest rates, fees, and other factors that align with your needs.

- Gather Required Documentation: Prepare the necessary documentation, such as a government-issued ID, proof of address, and any additional information required by the financial institution.

- Apply Online or In-Person: Many banks and credit unions offer the option to apply for a high yield savings account online or in person at a branch location.

- Fund Your Account: Once your account is approved, you can fund it through various methods, such as transferring funds from an existing account, setting up direct deposit, or mailing a check.

- Monitor and Manage: Regularly monitor your account balance, interest earnings, and any changes in interest rates or account terms and conditions.

Managing and Tracking Your Savings Progress

Maintaining a proactive approach to managing and tracking your savings progress is essential to ensure you stay on track and maximize the benefits of your high yield savings account. Here are some strategies to consider:

- Set Specific Savings Goals: Clearly define your short-term and long-term savings goals, such as building an emergency fund, saving for a down payment, or funding a dream vacation. Having specific targets in mind will help you stay motivated and focused.

- Create a Budget and Automate Savings: Develop a realistic budget that allocates a portion of your income towards your savings goals. Automate transfers from your checking account to your high yield savings account to ensure consistent contributions.

- Track Your Progress: Regularly monitor your account balance and interest earnings to track your progress towards your savings goals. Consider using budgeting apps or spreadsheets to visualize your savings growth over time.

- Celebrate Milestones: As you reach important savings milestones, take the time to celebrate your achievements and acknowledge the hard work and discipline it took to get there. This positive reinforcement can help maintain your motivation.

- Adjust and Adapt: Periodically review your savings strategy and make adjustments as needed. Changes in your financial situation, interest rates, or life circumstances may require you to recalibrate your approach to stay on track.

Conclusion: Start Growing Your Savings with the Best High Yield Savings Accounts

In the pursuit of financial growth and stability, high yield savings accounts offer a powerful tool to maximize your savings potential. By taking advantage of higher interest rates and the compounding effect, you can watch your money grow at an accelerated pace, bringing you closer to achieving your financial dreams.

Remember, the key to success lies in diligent research, careful consideration of your needs and goals, and a disciplined approach to saving. Embrace the opportunities presented by high yield savings accounts, and embark on a journey towards financial prosperity.

Take action today and explore the high yield savings account options available to you. By making an informed decision and committing to consistent contributions, you can unlock the path to substantial savings growth and financial security. Don’t let this opportunity pass you by – start maximizing your savings potential with the best high yield savings accounts on the market.