Introduction: The importance of canceling unused subscriptions

In today’s digital age, subscriptions have become a ubiquitous part of our lives. From streaming services to software tools, we often sign up for various offerings without realizing the long-term financial implications. However, failing to cancel subscriptions we no longer use can result in a significant drain on our wallets. It’s crucial to take control of our subscriptions and ensure that we’re not paying for services we don’t actively utilize.

Why do people forget to cancel subscriptions?

There are several reasons why individuals may forget to cancel subscriptions they no longer need. Firstly, the convenience of automatic renewal can lead to complacency, as we tend to overlook services that continue to charge us without requiring active input. Additionally, some subscription providers intentionally make the cancellation process convoluted, hoping that users will simply forget or give up trying to cancel.

Secondly, the proliferation of subscriptions across various platforms and services can make it challenging to keep track of all active memberships. With our busy lives, it’s easy to lose sight of which subscriptions we’re still paying for, especially if we’re not actively using them.

The financial impact of unused subscriptions

The financial impact of unused subscriptions can be significant, especially when multiple services are involved. Even seemingly small monthly fees can add up quickly, resulting in hundreds or even thousands of dollars wasted annually. This money could be better allocated towards more important financial goals, such as saving for emergencies, paying off debts, or investing in long-term financial security.

Furthermore, the psychological impact of wasting money on unused subscriptions can be demotivating and lead to a sense of frustration or regret. By taking control of our subscriptions, we not only save money but also experience a sense of empowerment and financial responsibility.

Assessing your subscription usage and value

Before canceling any subscriptions, it’s essential to assess their usage and value. Take the time to evaluate each service you’re subscribed to and ask yourself the following questions:

- When was the last time I actively used this subscription?

- Does this subscription provide value commensurate with its cost?

- Are there alternative, more cost-effective options available?

- Can I temporarily pause or downgrade the subscription instead of canceling it outright?

By answering these questions honestly, you’ll gain clarity on which subscriptions are truly valuable and worth keeping, and which ones you can confidently cancel without sacrificing essential services or experiences.

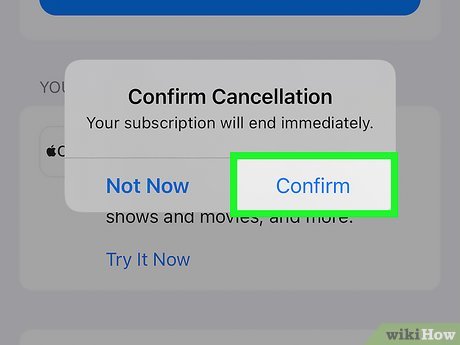

Steps to cancel subscriptions without being charged

Once you’ve identified the subscriptions you no longer need, it’s time to take action and cancel them without incurring any additional fees. Here are the steps to follow:

- Locate the subscription details: Gather all the necessary information for each subscription, including the service provider, account details, and any relevant login credentials.

- Check the cancellation policy: Review the cancellation policy for each subscription to understand the process and any potential fees or penalties. Some providers may offer a grace period or prorated refunds, which could save you money.

- Contact customer support: If the cancellation process is not straightforward, reach out to the provider’s customer support team. Be polite but firm in your request to cancel, and ask for any applicable refunds or credits for unused portions of your subscription.

- Follow up and document: After initiating the cancellation process, follow up to ensure it has been processed correctly. Keep records of your interactions, including dates, times, and the names of any customer service representatives you spoke with.

- Monitor your accounts: Continue to monitor your bank statements and credit card accounts to ensure that no further charges are made after the cancellation date. If you notice any unauthorized charges, contact the provider immediately to resolve the issue.

Contacting customer support for cancellation

When contacting customer support to cancel a subscription, it’s essential to be prepared and persistent. Here are some tips to help you navigate the process effectively:

- Gather all relevant information: Have your account details, subscription start date, and any previous correspondence with the provider readily available.

- Be polite but firm: While it’s important to remain courteous, be clear and firm in your intention to cancel the subscription. Avoid getting sidetracked by upselling attempts or retention offers.

- Escalate if necessary: If the initial customer service representative is uncooperative or unable to assist with the cancellation, politely request to speak with a supervisor or manager.

- Document everything: Keep a record of all interactions, including dates, times, and the names of the representatives you spoke with, in case you need to reference them later.

- Consider alternative communication channels: If phone support is proving challenging, explore other options such as live chat, email, or social media channels to communicate your cancellation request.

Remember, you have the right to cancel any subscription you no longer need or want, and customer support should respect your decision without attempting to dissuade or mislead you.

Utilizing subscription management tools and apps

In addition to manually canceling subscriptions, there are various tools and apps available that can help you manage and monitor your subscriptions more effectively. Here are some popular options:

- Subscription tracking apps: Apps like Truebill, Bobby, and Subscript offer features to track and manage your subscriptions across various platforms. They can provide insights into your subscription spending, send reminders for renewals, and even facilitate cancellations.

- Virtual credit cards: Services like Privacy.com and Cred.co allow you to generate virtual credit card numbers specifically for subscriptions. This makes it easier to track and cancel individual subscriptions without impacting your primary credit card.

- Browser extensions: Browser extensions like Honey and Trim can help you identify and cancel subscriptions directly from your online accounts or shopping carts.

- Personal finance apps: Many popular personal finance apps, such as Mint and YNAB (You Need A Budget), offer subscription tracking and management features as part of their overall budgeting and expense tracking capabilities.

While these tools can be incredibly helpful, it’s still important to regularly review and assess your subscription usage to ensure you’re not paying for services you no longer need or want.

Monitoring your bank statements and credit cards

Even after canceling subscriptions, it’s crucial to monitor your bank statements and credit card accounts closely. Occasionally, subscription providers may continue to charge you due to errors or miscommunications. Here are some tips to help you stay on top of potential unauthorized charges:

- Set up alerts: Many banks and credit card companies offer alert systems that can notify you of recurring charges or transactions above a certain amount. Take advantage of these features to stay informed about any potential subscription charges.

- Review statements regularly: Make it a habit to review your bank and credit card statements thoroughly each month. Look for any unfamiliar charges or subscriptions you thought you had canceled.

- Dispute unauthorized charges: If you notice unauthorized charges from a subscription you’ve already canceled, contact your bank or credit card company immediately to dispute the charges and request a refund.

- Consider subscription-specific credit cards: Some individuals find it helpful to use a dedicated credit card solely for subscriptions. This way, it’s easier to monitor and manage all subscription-related charges in one place.

By staying vigilant and monitoring your accounts regularly, you can quickly identify and address any unauthorized subscription charges, ensuring that you’re not paying for services you no longer use or want.

Tips for avoiding future subscription charges

While canceling existing subscriptions is essential, it’s also crucial to develop strategies to avoid accumulating unnecessary subscriptions in the future. Here are some tips to help you stay in control:

- Evaluate new subscriptions carefully: Before signing up for a new subscription, carefully consider its value and whether you’ll actually use it regularly. Avoid impulse sign-ups or free trials that automatically convert to paid subscriptions.

- Set reminders: When you do sign up for a new subscription, set reminders for yourself to reevaluate its usefulness before the next billing cycle. This will help you avoid forgetting about it and potentially paying for something you no longer need.

- Utilize free alternatives: Explore free alternatives or open-source options before committing to paid subscriptions, especially for software or productivity tools.

- Share subscriptions: Consider sharing subscriptions with friends or family members when applicable, splitting the cost and reducing individual expenses.

- Negotiate or downgrade: If you find a subscription valuable but too expensive, explore options to negotiate a better rate or downgrade to a more affordable tier.

By adopting these habits and being mindful of your subscription choices, you can significantly reduce the likelihood of accumulating unnecessary subscription charges in the future.

Conclusion: Taking control of your subscriptions and saving money

Canceling unused subscriptions is a crucial step towards financial responsibility and saving money. By following the steps outlined in this article, you can effectively identify and cancel subscriptions you no longer need without incurring additional fees.

Remember, every dollar saved from unnecessary subscriptions is a dollar that can be redirected towards more meaningful financial goals, such as building an emergency fund, paying off debt, or investing in your future.

Take control of your subscriptions today and experience the peace of mind that comes with knowing your hard-earned money is being spent wisely.