What are home equity loans?

As a homeowner, you may have heard about home equity loans but are unsure what they entail. A home equity loan is a type of secured loan that allows you to borrow against the equity you’ve built up in your property. Equity refers to the portion of your home’s value that you own outright, minus any outstanding mortgage balance. These loans can be a valuable financial tool for homeowners seeking to access funds for various purposes while leveraging the value of their property.

Home equity loans function similarly to traditional mortgages, with the primary difference being that you’re borrowing against the equity you’ve already accumulated rather than taking out a new loan to purchase a property. The loan amount is typically capped at a percentage of your home’s appraised value, ensuring that you maintain a certain level of equity.

By understanding the concept of home equity loans, you can explore opportunities to unlock the potential value of your property and make informed decisions about your financial goals.

Understanding the value of your property

Before delving into the specifics of home equity loans, it’s crucial to have a clear understanding of your property’s value. The equity you’ve built up in your home serves as the foundation for determining your eligibility and the potential loan amount you can secure.

Several factors contribute to the value of your property, including:

- Location: The desirability of your neighborhood, proximity to amenities, and overall market conditions in your area can significantly influence your home’s value.

- Property condition: Well-maintained properties with modern updates and renovations tend to command higher values compared to those in need of repairs or renovations.

- Market trends: Real estate market trends, such as supply and demand dynamics, interest rates, and economic conditions, can impact property values.

By regularly monitoring your property’s value and staying informed about local market conditions, you can better understand the equity you’ve accumulated and make informed decisions regarding home equity loans.

Benefits of home equity loans

Home equity loans offer several advantages that make them an attractive option for homeowners seeking to access funds while leveraging their property’s value. Here are some key benefits:

- Access to significant funds: Depending on the equity you’ve built up, you may be able to access a substantial amount of money through a home equity loan. This can be particularly useful for large expenses such as home renovations, debt consolidation, or funding a child’s education.

- Potentially lower interest rates: Home equity loans often have lower interest rates compared to unsecured loans or credit cards, making them a more cost-effective borrowing option.

- Tax advantages: In certain cases, the interest paid on home equity loans may be tax-deductible, providing additional financial benefits (consult a tax professional for specific guidance).

- Flexible repayment terms: Home equity loans typically offer flexible repayment terms, allowing you to structure your payments in a way that aligns with your budget and financial goals.

By understanding the benefits of home equity loans, you can make an informed decision about whether this financial tool aligns with your specific needs and objectives.

Factors that affect home equity loan rates

While home equity loans can offer attractive interest rates, it’s important to understand the factors that influence these rates. By being aware of these elements, you can better navigate the loan process and secure favorable terms. Here are some key factors that impact home equity loan rates:

- Credit score: Your credit score plays a significant role in determining the interest rate you’ll be offered. Lenders view higher credit scores as an indication of lower risk, resulting in more favorable rates.

- Loan-to-value ratio (LTV): The LTV ratio is calculated by dividing the loan amount by the appraised value of your property. A lower LTV ratio generally translates to a lower interest rate, as it represents a lower risk for the lender.

- Loan term: The repayment period, or loan term, can also affect the interest rate. Longer loan terms typically come with higher interest rates, while shorter terms may offer lower rates.

- Lender’s policies and market conditions: Different lenders may have varying policies and risk assessments, which can impact the interest rates they offer. Additionally, broader market conditions, such as economic trends and competition among lenders, can influence home equity loan rates.

By understanding these factors, you can take steps to improve your credit score, manage your LTV ratio, and shop around for the most favorable terms from different lenders.

How to qualify for a home equity loan

To qualify for a home equity loan, lenders typically evaluate several criteria to assess your creditworthiness and the value of your property. Here are some common requirements you may need to meet:

- Equity requirements: Most lenders have a minimum equity requirement, often ranging from 15% to 20% of your home’s appraised value. This ensures that you maintain a sufficient equity cushion after taking out the loan.

- Credit score: Lenders generally have minimum credit score requirements, with higher scores increasing your chances of approval and potentially securing better interest rates.

- Debt-to-income ratio: Your debt-to-income ratio (DTI) is calculated by dividing your monthly debt obligations by your gross monthly income. Lenders typically prefer a DTI below a certain threshold, such as 43%, to ensure you have sufficient income to cover the loan payments.

- Employment and income verification: Lenders will require documentation to verify your employment status and income sources, such as pay stubs, tax returns, or bank statements.

- Property appraisal: An appraisal will be conducted to determine the current market value of your property, which is used to calculate your available equity and the potential loan amount.

By understanding these qualification criteria, you can assess your readiness for a home equity loan and take steps to improve your chances of approval, if necessary.

Discover home equity loans and their features

As you explore the world of home equity loans, it’s essential to understand the various features and options available. Different lenders may offer unique products with varying terms and conditions, so it’s crucial to familiarize yourself with the key features to make an informed decision.

- Fixed-rate vs. adjustable-rate loans: Home equity loans can come with either fixed or adjustable interest rates. Fixed-rate loans provide predictable monthly payments throughout the loan term, while adjustable-rate loans may have lower initial rates but can fluctuate over time based on market conditions.

- Loan terms: Lenders typically offer home equity loans with various repayment periods, ranging from 5 to 30 years. Longer terms may result in lower monthly payments but higher overall interest costs, while shorter terms can save on interest but require higher monthly payments.

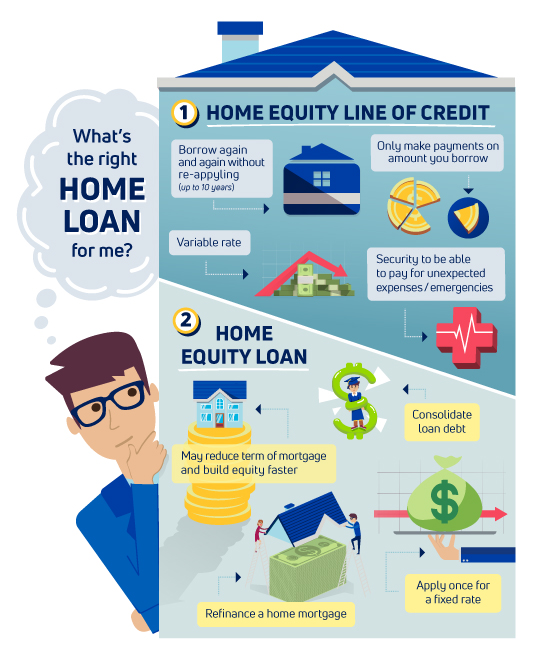

- Lump-sum vs. line of credit: Some lenders offer a lump-sum home equity loan, where you receive the full loan amount upfront. Others provide a home equity line of credit (HELOC), which functions like a revolving credit line that you can draw from as needed.

- Interest-only payment options: Certain home equity loans may offer an interest-only payment option, where you initially pay only the interest charges, followed by principal and interest payments later in the loan term.

- Closing costs and fees: As with traditional mortgages, home equity loans may involve closing costs and fees, such as appraisal fees, origination fees, and title insurance. Understanding these costs upfront can help you budget accordingly.

By exploring the various features and options available, you can find a home equity loan product that aligns with your specific financial needs and preferences.

Comparing interest rates

One of the key considerations when obtaining a home equity loan is the interest rate you’ll be charged. Interest rates can vary significantly among lenders, so it’s crucial to shop around and compare offers to find the most favorable terms.

Here are some tips for comparing interest rates on home equity loans:

- Check with multiple lenders: Don’t limit yourself to a single lender. Reach out to various banks, credit unions, and online lenders to obtain multiple quotes and compare rates.

- Consider your credit score: Your credit score plays a significant role in determining the interest rate you’ll be offered. Lenders with higher credit score requirements may offer lower rates, so be sure to check their specific criteria.

- Evaluate the loan-to-value ratio (LTV): Lenders typically offer lower interest rates for loans with lower LTV ratios, as these represent lower risk. Consider the maximum LTV ratio each lender allows and how it impacts the interest rate.

- Understand the rate type: Decide whether you prefer a fixed or adjustable interest rate based on your financial goals and risk tolerance. Compare rates for each type of loan across multiple lenders.

- Factor in fees and closing costs: While interest rates are important, don’t forget to consider any associated fees and closing costs, as these can impact the overall cost of the loan.

By diligently comparing interest rates and factoring in all relevant costs, you can make an informed decision and secure the most favorable terms for your home equity loan.

Tips for maximizing the value of your property

Once you’ve secured a home equity loan, it’s essential to utilize the funds strategically to maximize the value of your property. Here are some tips to help you achieve this goal:

- Invest in home improvements: One of the most common uses of home equity loans is to finance home renovations or improvements. These projects can not only enhance your living space but also potentially increase your property’s value. Focus on high-impact renovations such as kitchen and bathroom remodels, energy-efficient upgrades, or adding living space.

- Consolidate high-interest debt: If you’re carrying high-interest debt, such as credit card balances or personal loans, a home equity loan with a lower interest rate can help you consolidate and potentially save on interest charges over time.

- Fund education or business expenses: Home equity loans can provide the necessary funds to pursue educational opportunities or invest in a business venture. These investments in your future can ultimately contribute to your overall financial well-being and potentially increase your earning potential.

- Leverage real estate investments: For those interested in real estate investing, a home equity loan can provide the capital needed to purchase additional properties or fund renovations on investment properties.

- Maintain a disciplined repayment plan: While leveraging your home’s equity can be advantageous, it’s crucial to maintain a disciplined repayment plan. Failing to make timely payments can put your home at risk and potentially diminish the value you’ve built up.

By carefully considering the use of your home equity loan funds and implementing a strategic plan, you can maximize the value of your property while achieving your financial goals.

Alternatives to home equity loans

While home equity loans can be a valuable financial tool, they may not be the best fit for every situation. It’s essential to explore alternative options and determine the most suitable solution for your specific needs. Here are some alternatives to consider:

- Home equity line of credit (HELOC): A HELOC functions similarly to a home equity loan, but instead of receiving a lump sum, you have access to a revolving line of credit. This can be advantageous if you need funds for ongoing projects or expenses.

- Cash-out refinance: With a cash-out refinance, you refinance your existing mortgage for a higher amount than what you currently owe, allowing you to pocket the difference in cash. This option may be preferable if you can secure a lower interest rate than your current mortgage.

- Personal loans or credit cards: For smaller expenses or short-term financing needs, unsecured personal loans or credit cards may be more suitable alternatives. However, these options often come with higher interest rates and may not provide the same tax benefits as home equity loans.

- Reverse mortgage: If you’re a homeowner aged 62 or older, a reverse mortgage can allow you to access a portion of your home’s equity without having to make monthly payments. This option is best suited for those who plan to remain in their homes for an extended period.

- Borrowing from retirement accounts: Depending on your circumstances, borrowing from a 401(k) or other retirement account may be an option. However, this approach carries risks and potential penalties, so it’s essential to carefully consider the implications.

By evaluating these alternatives alongside home equity loans, you can make an informed decision that aligns with your financial goals, risk tolerance, and overall financial situation.

Conclusion

Home equity loans can be a powerful financial tool for homeowners seeking to unlock the value of their property. By understanding the key concepts, benefits, and factors that influence these loans, you can make informed decisions and leverage your home’s equity to achieve your goals.

Whether you’re planning home renovations, consolidating debt, funding education, or pursuing other financial objectives, a home equity loan can provide the necessary funds while offering potentially lower interest rates and flexible repayment terms.

However, it’s crucial to approach home equity loans with caution and diligence. Carefully evaluate your creditworthiness, property value, and repayment capacity to ensure you qualify for favorable terms. Additionally, explore alternative options and compare offers from multiple lenders to secure the most advantageous rates and terms.

By maximizing the value of your property through the strategic use of a home equity loan, you can unlock new opportunities for personal and financial growth while leveraging one of your most valuable assets – your home.